Coverage for Cialis by Blue Cross Blue Shield varies by plan and location. Contact your specific plan provider for details on Cialis coverage.

Erectile dysfunction (ED) medications like Cialis often raise questions regarding insurance coverage. Blue Cross Blue Shield, a prominent health insurance network, provides plans that may cover prescription drugs, including Cialis, depending on the plan’s formulary and the patient’s particular health needs.

It’s crucial to review your policy or speak with a BCBS representative to understand your coverage. Insurance plans consider factors such as medical necessity and the availability of generic alternatives when determining coverage. For the most accurate information, check your plan’s benefits or consult with your healthcare provider, who can assist with prior authorization if necessary.

Cialis Overview

Many wonder about Blue Cross Blue Shield’s coverage for Cialis. Let’s explore what Cialis is and its benefits. This medication is a popular choice for treating erectile dysfunction (ED). Understanding its coverage is crucial for those considering it.

Cialis, also known by its generic name tadalafil, is a medication used to treat erectile dysfunction (ED). It helps increase blood flow to the penis, aiding in achieving and maintaining an erection. Unlike some other ED medications, Cialis offers a longer duration of action, making it a favored option for many.

Key Benefits Of Cialis

- Long-lasting effects: Cialis can work up to 36 hours.

- Flexibility: It allows for more spontaneous sexual activity.

- Improved ED symptoms: It effectively helps achieve and maintain an erection.

How Does Cialis Work?

Cialis works by relaxing the blood vessels in the penis, which enhances blood flow. This process is essential for achieving and maintaining an erection. Its unique ability to last up to 36 hours provides a significant advantage over other ED treatments.

Is Cialis Right For You?

Choosing Cialis depends on individual needs and medical history. It’s crucial to consult a healthcare professional before starting any new medication. They can provide personalized advice based on your specific health conditions and requirements.

Blue Cross Blue Shield Basics

Many people wonder about the coverage of medications like Cialis under their health insurance plans. Blue Cross Blue Shield is a well-known name in the health insurance marketplace. It offers a variety of plans, each with its own coverage specifics. This segment dives into the basics of Blue Cross Blue Shield and its offerings. It looks at whether this insurer covers Cialis, a medication commonly prescribed for erectile dysfunction. Understanding Blue Cross Blue Shield and the types of plans available helps policyholders make informed decisions about their healthcare needs.

What Is Blue Cross Blue Shield?

Blue Cross Blue Shield (BCBS) stands as a federation of 36 separate United States health insurance organizations and companies, providing health insurance to over 106 million Americans. BCBS is known for its wide range of healthcare plans tailored to meet the diverse needs of its members. The organization operates nationwide, offering various policies that include both individual and group health insurance. It’s crucial for members to review their policy details to understand what medications and services are covered. Blue Cross Blue Shield’s coverage for prescription drugs like Cialis can vary based on the specific plan and the state in which the member resides. The federation’s commitment to health and wellness is evident in its extensive network of healthcare providers and resources aimed at improving the quality of healthcare while maintaining affordability.

Types Of Plans Offered

Blue Cross Blue Shield offers a comprehensive range of health insurance plans designed to cater to different needs and budgets. The plans fall into several categories, including but not limited to:

- Health Maintenance Organization (HMO) Plans: These require members to choose a primary care physician and get referrals to see specialists.

- Preferred Provider Organization (PPO) Plans: These offer more flexibility in choosing healthcare providers and do not usually require referrals.

- Exclusive Provider Organization (EPO) Plans: EPO plans combine the flexibility of PPO plans and the cost-savings of HMO plans but limit coverage to network providers.

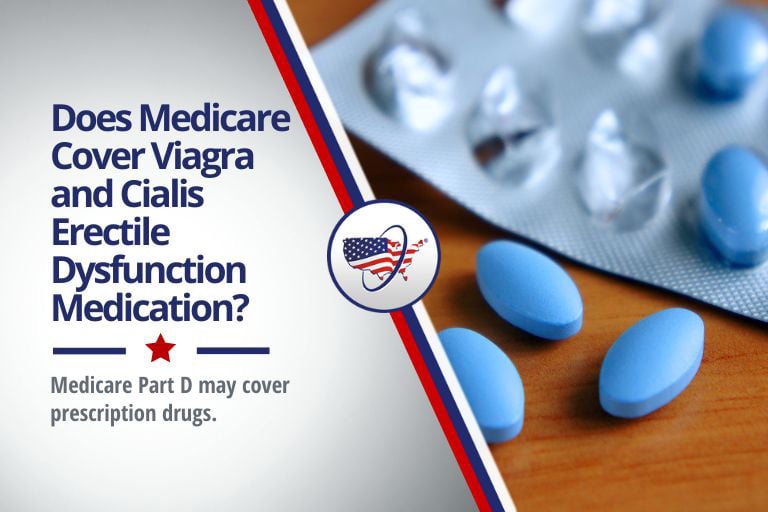

- Medicare and Medicaid Plans: BCBS provides coverage options for these federal programs, which cater to seniors and low-income individuals.

The details of what each plan covers can vary widely, including the coverage for medications such as Cialis. Members should carefully review their plan’s formulary, which is a list of covered medications, to see if Cialis is included. The formulary may also provide information on any requirements for coverage, such as prior authorization or quantity limits. Understanding the specifics of the plan’s prescription drug coverage is essential for members who need medications like Cialis for their health and well-being.

Prescription Coverage

When it comes to managing health, understanding your prescription coverage is key. Blue Cross Blue Shield, a leading health insurance provider, offers various plans, each with its own set of benefits. A common query is whether Blue Cross Blue Shield covers Cialis, a medication used primarily to treat erectile dysfunction. Let’s explore the coverage aspects and exclusions of Cialis under Blue Cross Blue Shield plans.

What Is Covered?

Blue Cross Blue Shield plans offer a range of prescription benefits, but coverage can vary based on the specific plan. Generally, medications fall under different tiers, and each tier has its own cost structure. Cialis, or its generic form, Tadalafil, might be covered under certain plans, but it often depends on the prescribed use and the plan’s formulary. The coverage details for Cialis might include:

- Dosage limitations

- Pre-authorization requirements

- Step therapy protocols

It’s crucial to check your plan’s summary of benefits for specifics. Here’s an example of how coverage might look:

| Medication | Tier | Copay | Prior Authorization |

|---|---|---|---|

| Cialis/Tadalafil | 3 | $40 | Yes |

Remember, the table above is just an illustration. Actual coverage will depend on individual plans. It’s important to contact Blue Cross Blue Shield directly or review your policy for the most accurate information.

Common Exclusions

While some plans might cover Cialis, there are common exclusions to be aware of. Many insurance plans have a list of drugs that are not covered, known as a formulary exclusion list. Exclusions can be due to a variety of reasons, such as availability of a generic form, cost-effectiveness, or clinical effectiveness of alternative therapies. Common reasons for excluding Cialis might include:

- Availability of generic alternatives

- Non-essential use (e.g., for enhancement rather than treatment)

- Less expensive drugs that serve the same purpose

Additionally, exclusions may occur if the medication is considered a lifestyle drug or if its primary use is not recognized as a medical necessity. Always review your plan’s exclusions and talk to your healthcare provider about possible alternatives. Here’s a simplified view of potential reasons for exclusion:

| Reason for Exclusion | Example |

|---|---|

| Generic Available | Tadalafil |

| Lifestyle Drug | Non-medical use |

| Cost-Effective Alternative | Other ED medications |

To avoid surprise costs, verify your plan’s details and discuss with your doctor the best treatment for your needs that aligns with your insurance coverage.

Cialis And Insurance

Many people wonder about insurance coverage for prescription medications, particularly for treatments like Cialis. Cialis, a drug used to treat erectile dysfunction (ED), can be a significant expense. Navigating the waters of insurance can be tricky. Let’s dive into whether Blue Cross Blue Shield (BCBS) provides coverage for Cialis and what factors influence this aspect of healthcare.

Cialis As A Prescription Drug

Cialis, also known by its generic name tadalafil, is a popular medication prescribed to manage erectile dysfunction and sometimes other conditions. It’s vital to understand how it’s covered by insurance. Here are key points about Cialis as a prescription drug:

- Approval: Cialis must be prescribed by a healthcare provider.

- Dosage: It comes in different doses, affecting coverage.

- Generic Option: The availability of generic versions may influence insurance decisions.

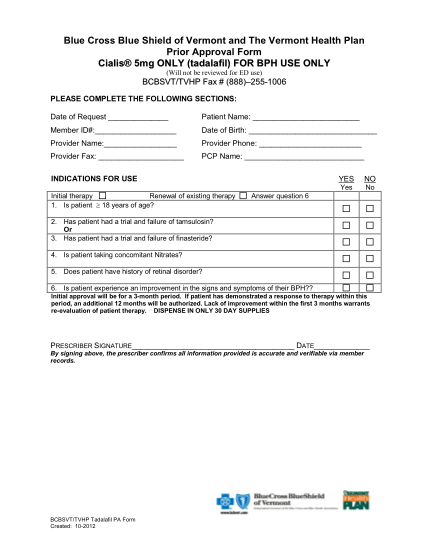

Insurance plans, including those offered by BCBS, may cover Cialis, but this often depends on the plan specifics and the reason for the prescription. For instance, while some plans may cover it for ED, others might only provide coverage if it’s prescribed for other FDA-approved conditions such as benign prostatic hyperplasia (BPH). It’s crucial to check with BCBS directly to understand your plan’s details.

Eligibility Criteria

When it comes to eligibility for insurance coverage of Cialis, several criteria come into play. These are factors that BCBS will consider:

- Medical Necessity: The prescription must be deemed necessary for the treatment of a diagnosed condition.

- Plan Type: Different BCBS plans have varying coverage levels and formularies.

- Prior Authorization: BCBS may require prior authorization to ensure that Cialis is the most appropriate treatment option.

Moreover, the patient’s medical history and the presence of specific health conditions might affect eligibility. To confirm your coverage for Cialis, it’s best to contact BCBS directly or review your policy’s summary of benefits. Be prepared to provide details about your prescription and medical need for Cialis. Understanding these criteria can help you navigate your coverage options and make informed decisions about your healthcare.

Plan-specific Details

Many people wonder if Blue Cross Blue Shield covers Cialis. The answer depends on the details of your plan. Each plan has different rules. Let’s dive into the specifics to understand better.

Hmo Vs. Ppo Plans

Blue Cross Blue Shield offers HMO and PPO plans. The coverage for Cialis can vary between these plans. Here’s what you need to know:

- HMO plans often need you to choose a primary care doctor. This doctor will guide your treatment and refer you to specialists. For Cialis, this means your primary doctor must agree it’s necessary. Then, they will refer you to a specialist if needed.

- PPO plans give you more freedom. You don’t need a primary care doctor’s referral to see a specialist. This can make getting Cialis easier if a specialist prescribes it.

| Plan Type | Need for Primary Doctor’s Referral | Ease of Getting Cialis |

|---|---|---|

| HMO | Yes | More Steps Involved |

| PPO | No | Easier Access |

Remember, even with PPO plans, coverage can vary. Always check your plan’s details.

State Variations

Blue Cross Blue Shield operates in many states. Each state can have different rules for Cialis coverage. Here’s a quick overview:

- Coverage levels can vary. Some states offer more comprehensive coverage for Cialis under certain conditions.

- States may have specific requirements for coverage. This might include prior authorization or proof that other treatments have not worked.

- Cost-sharing details, like copays and deductibles, can differ greatly from one state to another.

It’s crucial to check your specific state’s guidelines and your plan details. This ensures you know what’s covered and what you’ll need to pay out of pocket.

| State | Coverage Level | Special Requirements |

|---|---|---|

| California | High | Prior Authorization |

| Texas | Moderate | Proof of Need |

| Florida | Varies | Proof of Need, Prior Authorization |

Understanding these details can help you navigate your coverage options for Cialis more effectively.

Credit: www.singlecare.com

Cost Factors

Many people wonder if Blue Cross Blue Shield covers Cialis. The answer isn’t simple. It depends on your plan and where you live. Let’s dive into the cost factors that affect this coverage. These include co-pays, deductibles, and out-of-pocket expenses. Understanding these can help you plan your finances better.

Co-pays And Deductibles

Co-pays and deductibles are important parts of your health plan. Co-pays are what you pay each time you get a service. Deductibles are what you pay before your insurance starts to pay. Here’s how they work with Cialis coverage:

- Co-pays can vary. Some plans have low co-pays for medications like Cialis.

- Deductibles also vary. If you have a high deductible plan, you might pay more upfront.

Each Blue Cross Blue Shield plan has different rules. You should check your plan details. Here’s a simple table to help:

| Plan Type | Co-pay Amount | Deductible |

|---|---|---|

| Basic Plan | $10 | $500 |

| Premium Plan | $5 | $300 |

This table shows basic differences. Your plan might have different numbers.

Out-of-pocket Expenses

Out-of-pocket expenses are what you pay on your own. They include things not covered by insurance. Here’s what you need to know about out-of-pocket costs for Cialis:

- Not all plans cover Cialis. You might have to pay full price.

- Full price can be high. Cialis is not cheap.

- Some plans cover a part. You pay the rest.

Check your plan’s formulary. This is a list of covered drugs. It tells you how much you’ll pay. Also, consider generic options. They can be cheaper. Remember, planning helps manage costs better.

Alternatives To Cialis

Many people ask, “Does Blue Cross Blue Shield cover Cialis?” Coverage can vary, so it’s key to check with your plan. But don’t worry if it’s not covered, as there are many alternatives to Cialis for treating erectile dysfunction (ED). Let’s explore some of the options available that could help with this common issue.

Other Ed Medications

While Cialis is a popular choice, several other ED medications offer similar benefits. These drugs work by increasing blood flow to the penis, helping to achieve and maintain an erection. Below is a list of alternatives to consider:

- Sildenafil (Viagra): Often takes effect within 30 minutes and lasts for about 4 hours.

- Vardenafil (Levitra, Staxyn): Can work within 25 minutes and last up to 5 hours.

- Avanafil (Stendra): Has a rapid onset of action, as quick as 15 minutes, and may last up to 6 hours.

- Tadalafil (Adcirca): Also treats pulmonary arterial hypertension and may last up to 36 hours.

These medications require a prescription, so it’s essential to discuss with a healthcare provider. Consider the following table for a quick comparison:

| Medication | Onset of Action | Duration |

|---|---|---|

| Viagra | 30 minutes | 4 hours |

| Levitra | 25 minutes | 5 hours |

| Stendra | 15 minutes | 6 hours |

| Adcirca | 45 minutes | 36 hours |

It’s important to note that all these medications may have side effects and are not suitable for everyone.

Natural Remedies

Some individuals prefer natural remedies to manage ED. These options may support erectile function without the need for prescription medications. Here are some natural approaches:

- Exercise: Regular physical activity improves blood circulation and can lead to better erections.

- Diet: Foods rich in flavonoids, like berries and citrus fruits, could reduce the risk of ED.

- Herbs and Supplements: Some evidence suggests that L-arginine, ginseng, and other supplements might help.

- Stress Reduction: Practices like yoga and meditation can help alleviate stress, improving ED.

Consider the potential benefits and risks of each natural remedy:

| Natural Remedy | Potential Benefits | Considerations |

|---|---|---|

| Exercise | Enhances blood flow | Start slowly, build up |

| Diet | May lower ED risk | Eat a balanced diet with variety |

| Herbs and Supplements | Could improve erections | Check with a doctor before use |

| Stress Reduction | Decreases anxiety | Find a method that works for you |

It’s crucial to remember that natural remedies can interact with other medications. Always consult a healthcare provider before starting any new treatment regimen.

Credit: cocodoc.com

Claim Process

Understanding your health insurance can be tricky, especially when it comes to specific medications like Cialis. Blue Cross Blue Shield offers various plans, some of which may cover Cialis. Knowing the claim process is key to making sure you can access your benefits without stress. Let’s dive into how to file a claim and what to do if your claim is denied.

How To File A Claim

Filing a claim with Blue Cross Blue Shield for your Cialis prescription is a straightforward process. Follow these steps to ensure a smooth experience:

- Check your policy to confirm Cialis is covered under your plan.

- Gather your documents, including your prescription and any receipts from your pharmacy.

- Complete a claim form available from Blue Cross Blue Shield’s website or customer service.

- Submit the form along with your documents, either online, by mail, or through the mobile app.

Keep a copy of all submitted information for your records. You should receive a decision within a few weeks. If approved, you will be reimbursed based on your plan’s coverage. Below is an example of how your claim form details might look:

| Section | Details |

|---|---|

| Member Information | Your name, policy number, and contact information |

| Prescription Details | Name of medication, dosage, and prescription date |

| Pharmacy Information | Name and address of the pharmacy where you purchased Cialis |

| Payment Details | Amount paid and method of payment |

Appealing Denied Claims

If your claim for Cialis coverage is denied by Blue Cross Blue Shield, don’t lose hope. You have the right to appeal the decision. Start by understanding why your claim was denied by reviewing the explanation of benefits (EOB) sent by your insurer. Here are steps to take:

- Review the EOB for the specific reason your claim was denied.

- Contact customer service for more details on the denial and the appeal process.

- Collect supporting documents, such as a letter from your doctor explaining the necessity of Cialis.

- Submit a formal appeal in writing, detailing why you believe the claim should be covered.

- Follow up regularly to check the status of your appeal.

Appeals are usually reviewed within 30 to 60 days. During this time, keep track of all communications and stay informed about your appeal rights. If your appeal is denied, you may have further options, such as a second appeal or an external review. Remember, persistence is key, and understanding your coverage and rights can help you navigate the process effectively.

Credit: www.medicarefaq.com

Conclusion

Navigating insurance coverage can be complex, yet understanding your plan’s specifics is key. For those with Blue Cross Blue Shield, checking your policy details will clarify if Cialis is included. Don’t hesitate to reach out to your provider for personalized information.

Ensuring you’re informed helps maintain both your health and peace of mind.